Level-Funded Benefits

Get the Facts on Level-funded Benefits

More employers are opting to self-insure their employee benefits in order to gain more flexibility and control in plan design and financing. A well-designed self-insured plan enables companies to reap the benefits of their cost containment efforts and wellness activities, rather than paying a monthly premium to a commercial insurer based on an arbitrary set of ratings restrictions.

What Are Level-funded Benefits?

Level funding is a self-insurance hybrid that further enables companies to benefit from the regular and predictable costs of a fully insured plan, while only paying for the healthcare costs actually incurred by employees. This approach can potentially provide a 30 to 40 percent annual return of claims reserve on health benefit costs. This information sheet outlines some of the things you should know when considering whether level funding is right for you and your employees.

How Level Funding Works

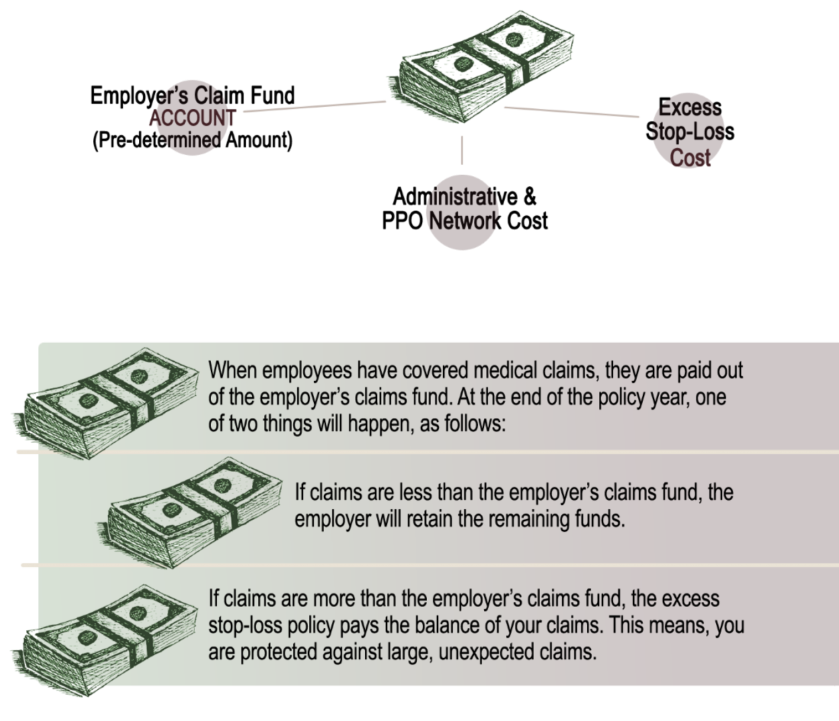

With level funding, you, as the employer, pay a set amount each month to a third party administrator to cover administrative costs, fees and embedded excess stop-loss coverage. Excess stop-loss coverage provides for financial risk limitations—or a cap—that serves as a financial buffer for your company, if for example, an employee is diagnosed with cancer or needs an organ transplant.

Companies put aside enough cash to cover anticipated claim expenses—called a claims fund—and your monthly payment for your benefits plan remains level for the entire year just like a fully insured health plan. If claims are less than the funded amount at the end of the year, the excess amount is retained by the plan. With PCG, you retain 100% of that excess amount. If claims go over the funded amount, your company is protected by excess stop-loss coverage. For companies that already self-insure and then switch to level funding, they can expect to benefit from a more budget-friendly method of monthly claims payment, because the employer has established a claims fund. However, it’s important to note that each state mandates a set minimum employee count in order to obtain excess stop-loss coverage, so this option, in some states, will not be open to extremely small employers.

Who Should Consider Level-funding

Ideally, level funding works best for companies that are:

- Looking for an affordable option that makes it possible for them to continue offering employer-sponsored benefits

- Interested in self insuring, but want to avoid the risk of unpredictable monthly costs

- Establishing a culture of health and wellness

- Have five or more employees

Advantages of Level-Funding

Level funding delivers all of the same advantages of self-funded benefits, including greater flexibility than commercial insurance, as well as a number of cost-saving benefits, such as:

- Helping employers tailor plans to the specific health needs of their workforce, especially if guided by the right third-party administrator (TPA)*

- Generating as much as 3% immediate savings, because state taxes are eliminated on most self-insured plans

- Eliminating insurance carrier profit margins and risk charges

*TPAs are explained in more detail later in this document

Furthermore, level-funded plans are exempt from many of the federal healthcare law’s health insurance taxes, which will be onerous for employers and employees who remain in the fully insured market.

Level-funded plans are not subject to:

- State-mandated benefits

- The jurisdiction of the states

- Typically, litigation in state courts or the appeal and complaint procedures of the insurance departments of each of the states

- Community Rating- Each self -funded plan’s cost is determined on the actual health status of its employees unlike fully insured plans that are rated by the profitability of the insurance companies block of all insured. For instance, a fully insured company might raise the rates of younger individuals to help offset the cost of older individuals in a separate company from the one the younger individuals work in. Self- Funded only rates the individuals in your company, you are not mixed into a large pool of multiple companies

With level-funded plans, employers only pay for claims and the cost of administering them, and they can conveniently be combined with flexible savings accounts (FSA), health savings accounts (HSA) and health reimbursement accounts (HRA). This means that, in addition to lowering healthcare costs, level funding helps companies remain competitive and gain an edge in attracting and retaining talent in their workforce.

How to Make the Most of Level Funding

In order to simplify the transition to and administration of a level-funded plan, companies should turn administrative responsibilities over to a TPA that has considerable expertise and a proven track record for:

- Maintaining eligibility

- Providing customer service

- Adjudicating and paying claims

- Preparing claim reports

- Negotiating, obtaining and renewing stop-loss placement

- Conducting enrollment information meetings

- Arranging managed care services, such as access to preferred provider networks, coverage for alternative treatment programs including acupuncture and chiropractic services, prescription drug card programs that offer cost-saving opportunities and utilization review

PCG can assist you in contracting with a TPA that can provide all this expertise and more.

Get Started With Level Funding

As you can see, level-funded benefits contain numerous cost saving advantages and help reduce risk of unpredictable monthly expenses. As the healthcare landscape continues to change, it makes sense to offer benefits in a way that reduces costs, increases profitability and promotes wellness in the workplace. PCG and Nationwide can help you create a level-funded benefits plan that meets the needs of your business and your employees.